The competition in the CRM market just got a lot more interesting. If I were Benioff, I’d be rethinking Salesforce’s two-decade dominance.

At ServiceNow’s SKO last week, they made waves with a bold statement: “We Are CRM.” While this may sound like a new foray, the truth is, ServiceNow has been steadily carving out its space in the CRM market since 2019, when they launched their Customer Service Management (CSM) product. That product quickly became the fastest-growing in ServiceNow’s history, achieving $1 billion ARR faster than anyone anticipated.

Since then, ServiceNow has expanded its reach and evolved into a comprehensive CRM solution. Their strategic verticalization, tailoring products for specific industries, has positioned them as a leader in key sectors like telecom, financial services, retail, manufacturing, and healthcare. This approach has proven to be a winning formula, and the momentum shows no signs of slowing.

ServiceNow’s differentiator lies in its ability to provide an end-to-end customer journey. By bundling a true platform solution, they’ve created seamless integrations between IT Service Management (ITSM), Field Service Management (FSM), and Customer Service Management (CSM). This eliminates the need for a patchwork of tools like Jira, Service Titan, and Zendesk. In other words, ServiceNow has enabled companies to manage their entire tech stack on a single platform, a game-changer for simplicity.

Where ServiceNow is Headed Next

As ServiceNow pushes deeper into the CRM space, their next big opportunities lie in Sales and Marketing.

Sales: A Natural Evolution

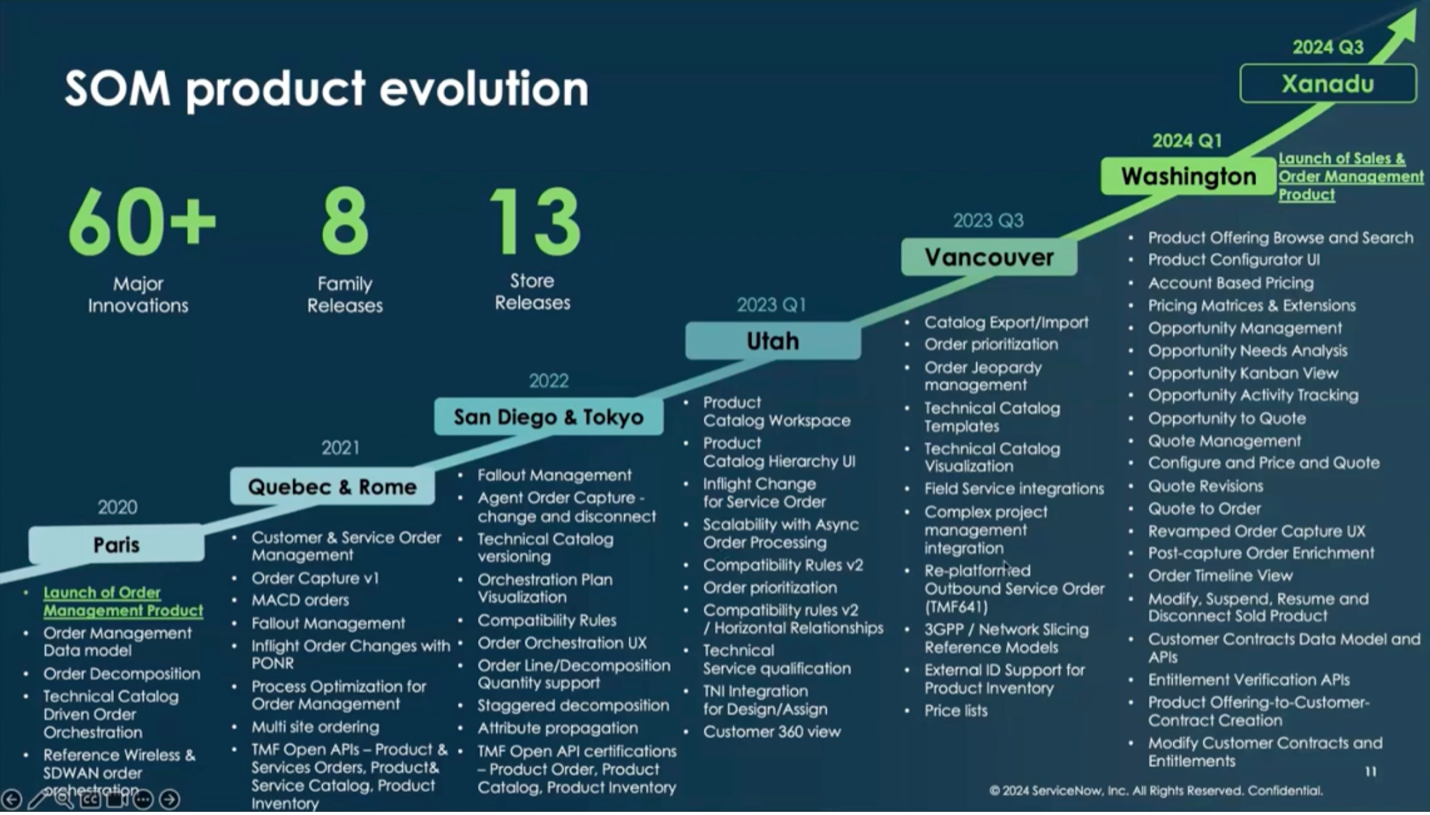

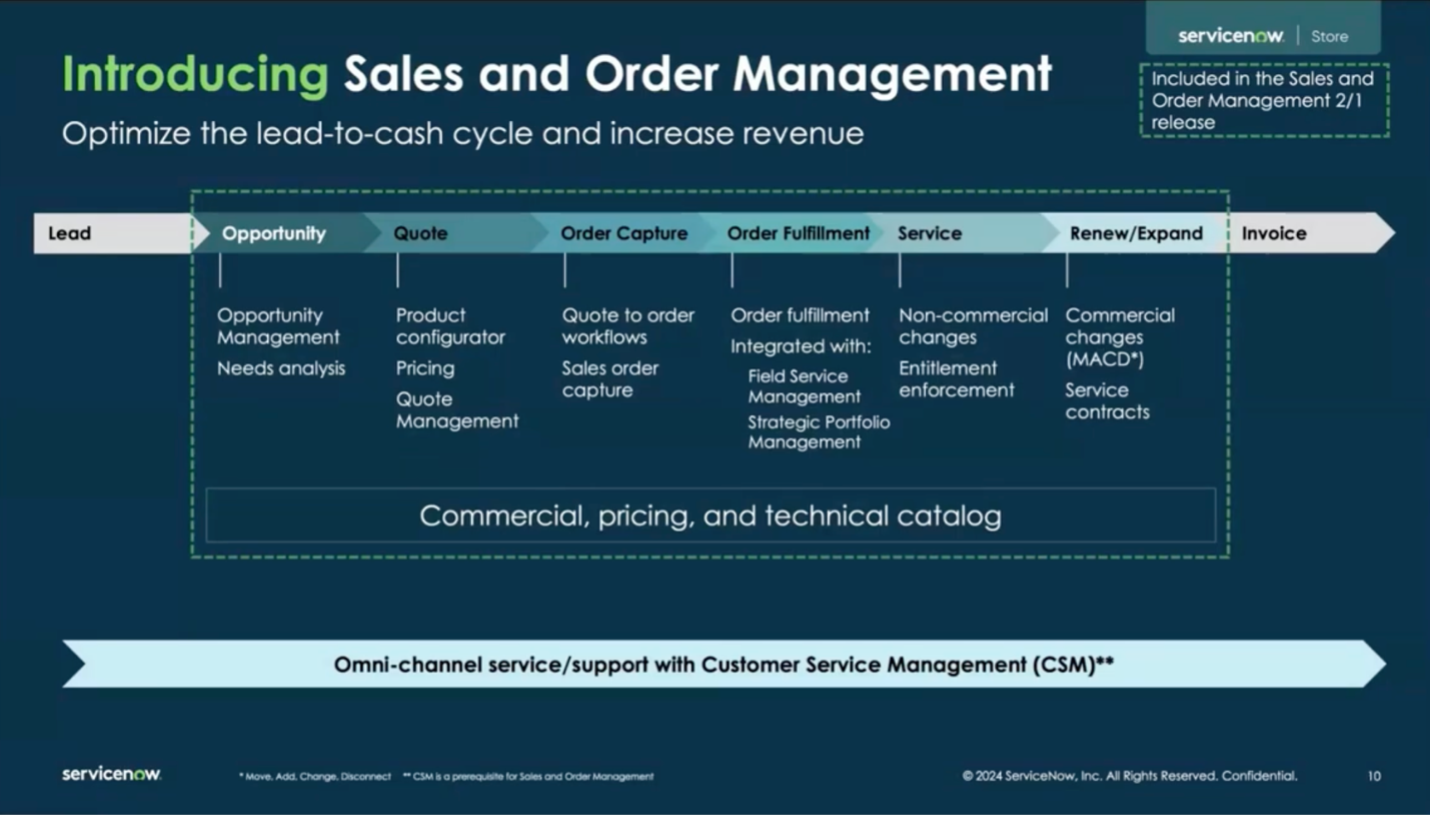

With the recent release of Sales and Order Management, ServiceNow is making its first serious moves into the sales domain. Their Order Management solution, particularly in the telco space, has already made a splash, with major telco providers adopting it to handle complex orders. ServiceNow’s product modeling and order decomposition capabilities are best-in-class, and their Opportunity Management, Quote Management, and Customer Lifecycle Workflows launched in 2024 are paving the way for a deeper presence in the sales lifecycle.

The logical next step? Tackling the earlier stages of the deal cycle. ServiceNow has already built much of the CRM framework, but can they convince enterprises to move away from Salesforce’s entrenched position? It’s no secret that Salesforce’s costs and vendor lock-in have created dissatisfaction among many enterprise customers. The platform’s reputation has taken a hit due to skyrocketing costs and the need for large, costly support teams.

With 85% of Fortune 500 companies already using ServiceNow for IT and other workflows (HR, App Engine, ITOM), expanding into sales is a natural progression. By uniting the sales process with other enterprise workflows, ServiceNow could deliver a truly seamless, end-to-end customer journey that sets them apart.

Marketing: A Competitive, but Promising Frontier

The marketing automation space is crowded, with players like Salesforce, HubSpot, and Klaviyo vying for dominance. But this is where ServiceNow’s platform capabilities could dominate.

While tools like HubSpot and Klaviyo excel at front-end customer engagement, they struggle to integrate into the full customer journey, especially when complex workflows, contracts, entitlements, and sold product support come into play. Yes, they support REST API integrations, but managing multiple tools leads to fragmentation and inefficiency. While HubSpot and Klaviyo primarily serve customers in the digital and commercial space, ServiceNow has made significant inroads into the mid-market over the past few years, establishing a strong foothold and showing no signs of slowing down.

ServiceNow, on the other hand, thrives in complex enterprise environments. Its ability to configure and customize workflows to meet intricate business needs positions it to outpace smaller, less adaptable vendors in this space.

The Big Picture

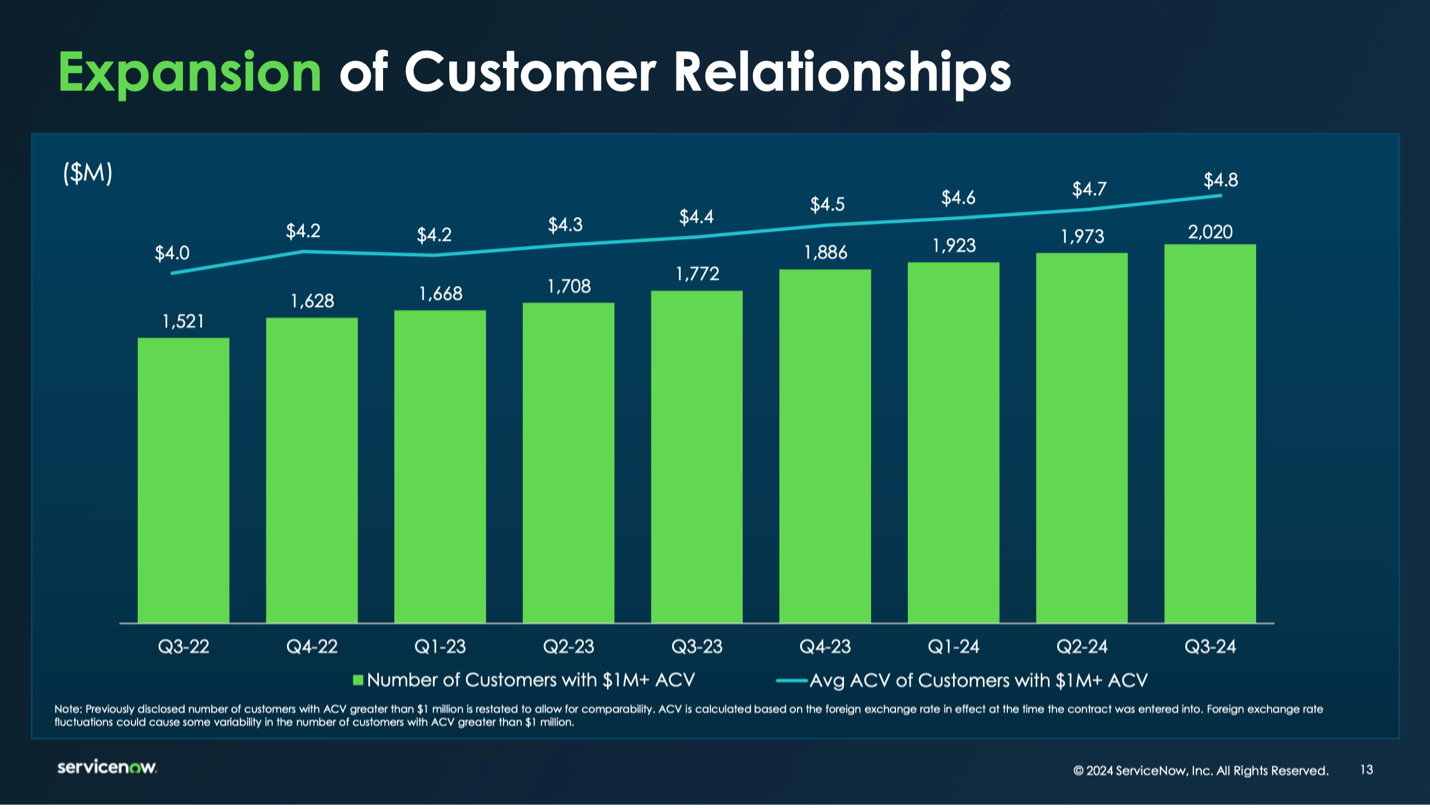

Over the last decade, ServiceNow has put on a master class in cross-selling across the enterprise, rocketing its revenue from $1 billion to $10 billion in record time. With an unparalleled platform architecture, industry-leading data structures, and a world-class leadership team, ServiceNow is well-positioned to shake up the CRM market in ways few expect.